Behavioural Design: Digital Ledger

Context

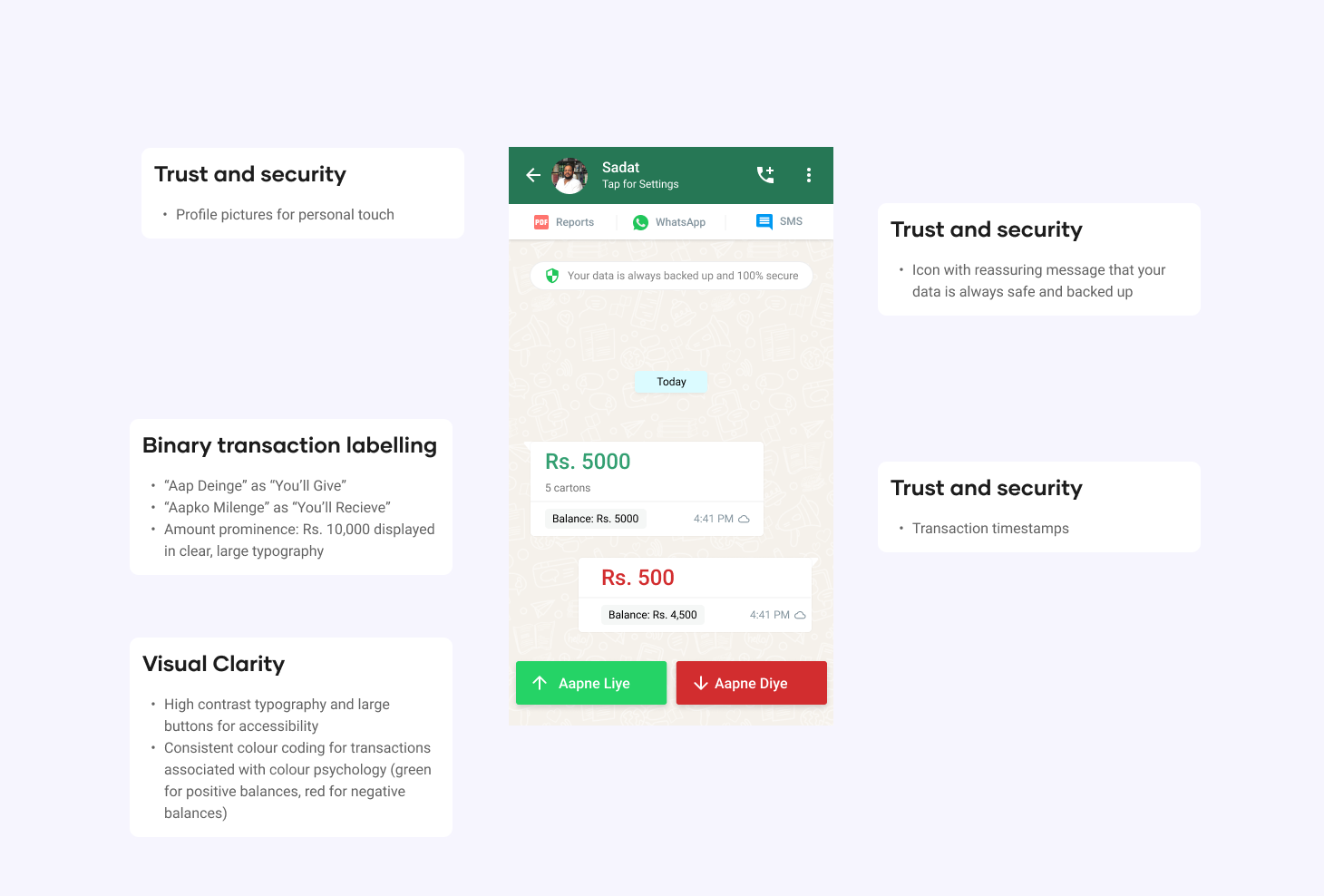

In 2019, during a 3-month study across Karachi and Lahore, I observed the inefficiencies of paper-based ledgers or “khatas” for small businesses. Manual reconciliation was time-consuming, error-prone and socially awkward when it came to reminding customers—often friends and family—to repay their credit on time. Small business owners spent hours communicating on WhatsApp despite a lack of formal literacy. Inspired by WhatsApp’s simple interface, we envisioned a solution that could seamlessly integrate into the lives of entrepreneurs. My approach:

Applying nudge theory to reduce friction in payment reminders via WhatsApp and SMS

Using participatory methods to design an interface based on simplicity and familiarity

Feedback and iterative testing to refine choice architecture and navigation

Outcomes included a 50% reduction in delayed payments and a 60% improvement in cash flow, showing the role of design in developing trust and engagement.

ROLE

Head of Design and Project Lead

TEAM

Product Designer II

Brand Lead

Head of Engineering

Software Engineer

TIMELINE

3 months, Live in May 2024

Problem

“How might we solve for the inefficiencies and social discomfort that paper-based ledgers create for small businesses, particularly when requesting timely repayments from within their networks.”

Hypothesis

By introducing a free digital ledger with a familiar interface, businesses would experience faster reconciliations and fewer issues with repayment reminders. Automating reminders via text messages could reduce social friction and improve cash flow management for businesses.

Process

We conducted an experiment across 8 weeks with 30 small retailers who used paper ledgers and reported cashflow problems across Karachi and Lahore. Building on the principles of Nudge Theory, we sent reminder text messages out to customers on behalf of the retailers at various time intervals to reduce the social awkwardness of direct personal reminders. We then converted our insights into screens, I borrowed learnings from Nir Eyal’s Hook Model, and tested the product with retailers.

Over 8 weeks, shopkeepers reported an improvement in cash-flows and timely repayments. We observed an organic increase in downloads from other businesses, suggesting the establishment of credibility due to social proof.

Over 8 weeks, shopkeepers reported an improvement in cash-flows and timely repayments. We observed an organic increase in downloads from other businesses, suggesting the establishment of credibility due to social proof.

We then launched and tested several iterations of the home screen to assess which was most accessible in terms of choice architecture, familiarity and visual clarity.

Learnings

1. Social Context Matters

Understanding social dynamics is crucial for business design

Digital solutions can help navigate sensitive social situations and create progressive engagement loops

2. Familiarity Breeds Adoption

Using known UI patterns (WhatsApp like) reduced learning friction

Leveraging existing mental models accelerated acceptance

3. Automation of Social Friction

Identifying and automating socially awkward interactions

Creating system driven defaults for difficult social tasks

Over 6 months, cash flow improved by up to 60%, with users reporting a 2x reduction in delayed payments on average.

150,000 Monthly Active Users

92% Net Promoter Score

4M transactions recorded

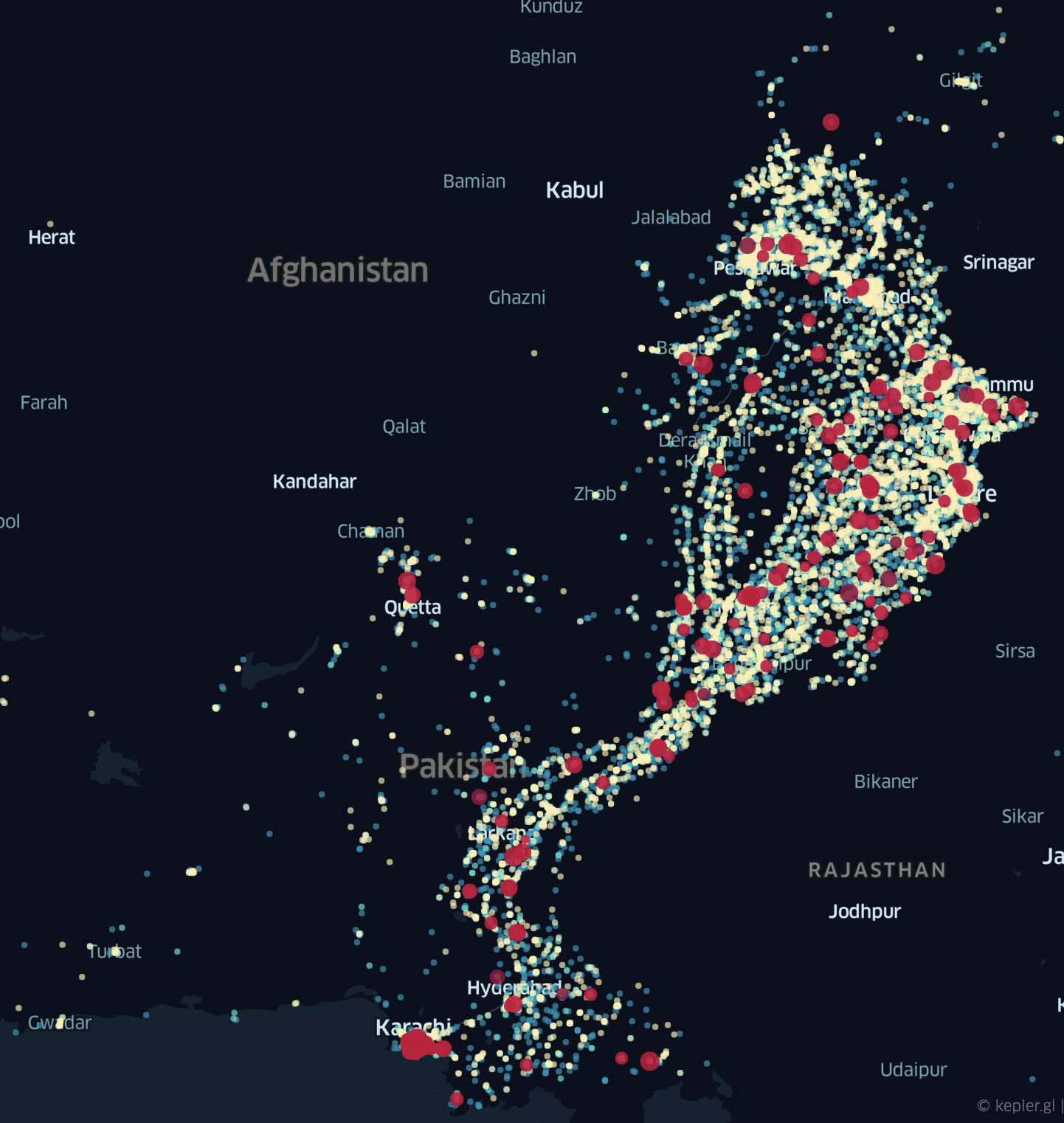

450 cities and towns