Using “Thick” Data to Build Personas

Context

By 2021, CreditBook’s digital ledger attracted 300,000 monthly active businesses from across Pakistan but the company’s growth was unsustainable without revenue generation. Given that ~60% of the country’s SMEs rely on informal financing to meet business needs, we saw an opportunity to finance businesses who used the app regularly. Since lending is culturally sensitive and religion influences beliefs about financial products, we set out to better understand who we were building for.

To guide the lending pilot, I applied data analytics and ethnography to better understand the needs, motivations and lived experiences of entrepreneurs that used the app. Key actions:

Analysing the financial data of power users to identify behavioural clusters

Drew on phenomenology to conduct 50 in depth interviews to understand motivations and cultural contexts

Built six personas to guide the company’s lending strategy

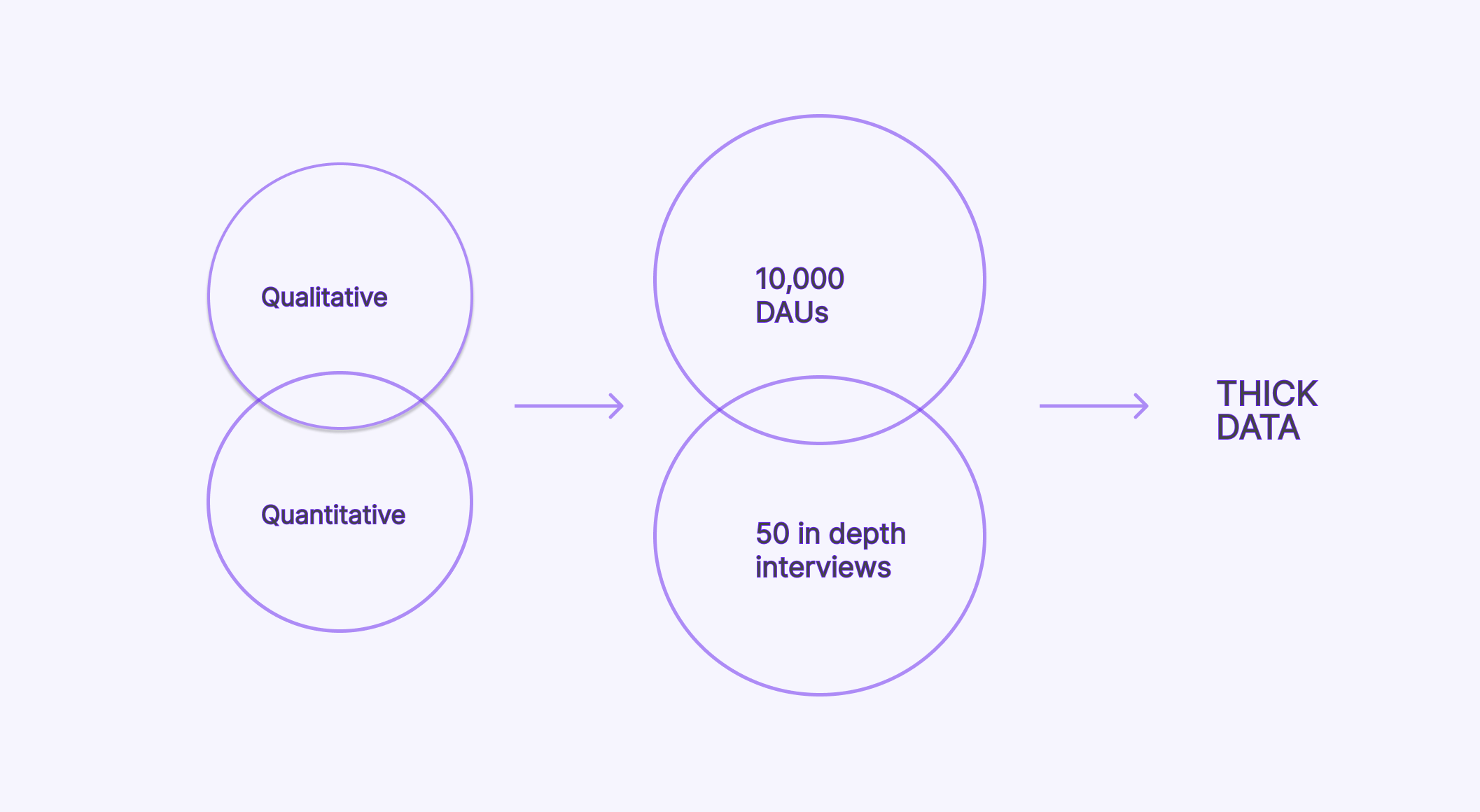

The process showed my ability to combine qualitative and quantitative data for actionable businesses decisions.

Problem Statement

“How might we identify app users that are willing and able to adopt a digital financing product to grow their business in the informal economy?”

Hypothesis

Active users who record credit transactions frequently are most likely to adopt digital financing products to grow their business.

Process

ROLE

Head of Design

TEAM

User Researcher I

User Researcher II

Data Analyst

Head of Data

TIMELINE

12 months

Clustering

Cleaning and analysing data to understand users with similar patterns based on the following variables

Time since active

Transaction frequency and size

Location

Feature usage

Financial literacy

We arrived at six main clusters based on business size, tech adoption, financial habits and risk tolerance. The activity was repeated after six months to track changes.

Interviews and Observations

Inspired by the philosophical concept of phenomenology, I led a team 3 user researchers, to conduct in-depth observations of 6 users across each cluster. Our goal was to understand their needs, motivations, and daily behaviors. We then conducted in depth interviews, made sense of the data through affinity and empathy mapping, and identified patterns of behaviour across variables like age groups, financial behaviours, family systems and belief systems.

Personas

Sumbul

Sumbul, 28, is a driven entrepreneur, managing a small general store in Karachi. Keen to expand her business, she adopts new technologies like POS systems. While she trusts CreditBook, her meticulous nature means she keeps backup paper records as a safety net.

Traits: Early tech adopter, meticulous financial management, growth-oriented, conservative.

Challenges: Balancing rapid expansion with the need for secure, reliable financial tools.

Opportunities: CreditBook can assist Sumbul by offering advanced financial analytics and shariah compliant financing for growth.

Fatima

Fatima, 31, has big ambitions for her tailoring business but is constrained by family responsibilities. Her desire to grow is hindered by time constraints, though she’s quick to embrace technology and wants to scale her business.

Traits: Ambitious, family and domestic responsibilities, tech-savvy but unsure about banking.

Challenges: Balancing family duties with business aspirations, lack of confidence in traditional banking systems.

Opportunities: CreditBook can provide flexible, simple digital financing options to help her manage both her business and family obligations efficiently.

Salma

Salma, late 50s, runs a small grocery store with the help of her children. She’s comfortable with her business’s size and uses CreditBook for convenience rather than expansion. Family is at the core of her decisions, and she values free, easy-to-use tools that align with her desire for stability.

Traits: Family-oriented, loyal to free solutions, stability-focused.

Challenges: No desire for growth, relies on family support for tech management.

Opportunities: CreditBook can ensure its free services remain comprehensive for users like Salma and introduce features that enhance the convenience of managing finances.

Zain

Zain, 33, runs a thriving garment shop. Confident and risk-taking, he expanded his business quickly through informal financing and personal assets. Supported by his family, Zain uses platforms like YouTube and Facebook to promote his products and is willing to take risks for growth.

Traits: Risk-taker, family-supported, tech-savvy, open to formal digital financing options.

Challenges: Balancing growth with sustainable investment practices.

Opportunities: CreditBook could offer Zain tailored insights to manage risk while pursuing growth through tech integrations.

Ali

Ali, 40, works as a store manager but has entrepreneurial aspirations. However, past failures have made him cautious, and limited financial resources hold him back from starting his own business. Though he understands the benefits of technology, he prefers traditional methods.

Traits: Entrepreneurial, demotivated by past failures, moderate tech literacy.

Challenges: Scarcity of resources, fear of repeating past mistakes.

Opportunities: CreditBook can help Ali rebuild his confidence with low-risk tools, business guidance, and practical financial resources.

Ahmad

Ahmad, 37, operates several small side businesses but has no strong desire to scale them. He focuses on affordability and steady, moderate income streams. While his entrepreneurial instincts are sharp, he values financial security over rapid expansion.

Traits: Multiple income streams, focused on affordability, not growth-driven.

Challenges: Limited motivation to grow beyond small ventures, financial conservatism.

Opportunities: CreditBook can offer Ahmad cost-efficient solutions that support his current ventures without pushing for expansion, such as tools to optimize his operations.

Conclusion

We arrived at 6 relatable personas across the clusters, each with a story, traits, and motivations. Inspired by the Grounded Theory approach and the concept of thick data, we turned these insights into stories that resonate with CreditBook’s mission and customer needs. Ultimately, our personas helped us understand who to approach and who not to approach for our first lending pilot.