Systems Thinking and Equity: Pivot

Context

In late 2023, I co-led a strategic pivot at CreditBook because there a growing need for a sustainable revenue model to support the company’s growth since launching the free mobile ledger app for micro, small and medium businesses. The focus was on identifying where value lies for these underserved businesses. Drawing on systems thinking and participatory design, we mapped out the inefficiencies faced by SMBs over a three month period. Key actions:

Observing SMB workflows to map pains and inefficiencies when managing cash flows

Designing solutions that made credit access simpler while building credit histories

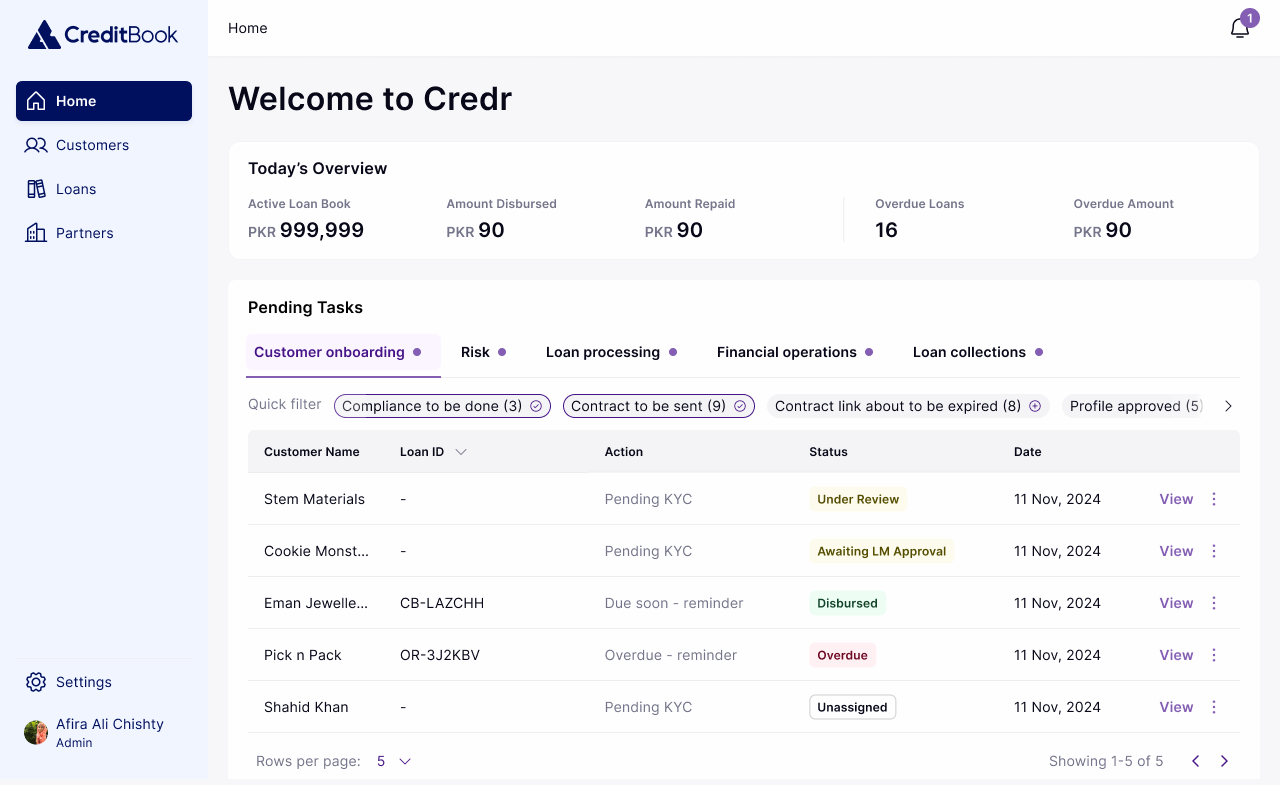

The pivot resulted in an loan operating system to process and manage all integrated finance offerings, ultimately leading to a month on month increase in loans of 20%, an increase in automation leading to cost savings of 200%, and over 8000 loans processed and disbursed at an average of 14 hours.

Problem

Only 7% of 5.2M SMBs in Pakistan receive traditional financing, resulting in poor cash-flow and slow growth opportunities. Despite digitisation, financial accessibility remains a gap, particularly for those lacking a formal credit history. We sought to:

Empower businesses with digital financing that is easy and accessible for their customers

Build credit history in a frictionless, user friendly way

Enable fast, reliable access to products with minimal red tape and increased automation

Opportunity

To expand CreditBook’s product suite and customer base, offering SMBs with solutions tailored to their needs.

For SMBs: meet unmet financing needs of end customers, leading to increased revenue and growth without investing resources in regulatory expertise

For Customers: expanded credit and affordable financial products creating new avenues for SMB customers to engage in commerce

For CreditBook: new revenue stream, larger customer base and better data for underwriting

ROLE

Head of Design

TEAM

Product Manager I

Product Designer II

Producer Designer II

User Researcher

TIMELINE

3 months

Process

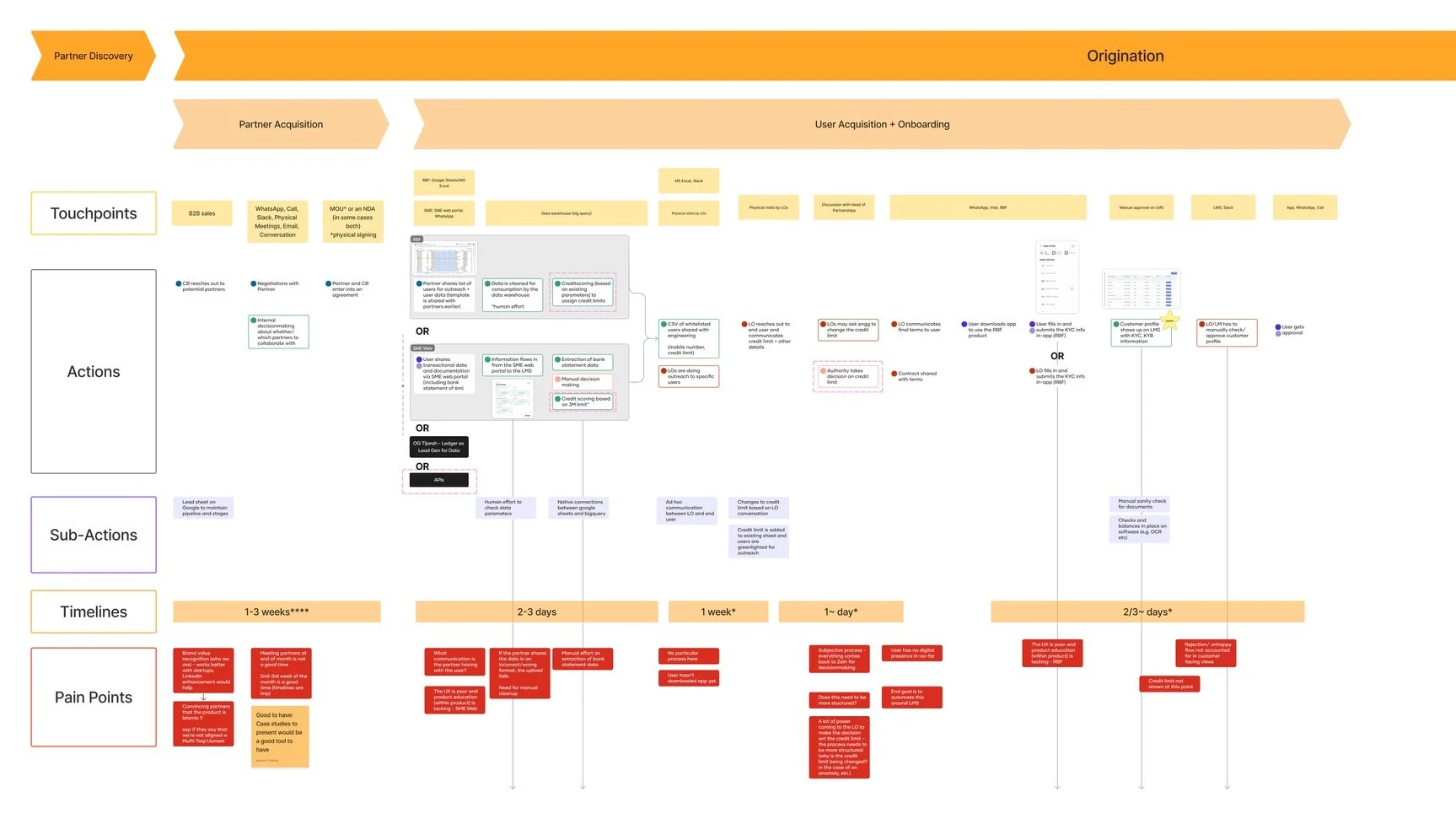

We observed the complex workflows of SMBs to understand their current journeys, how they manage cash flow, deal with credit limitations and interact with customers in their existing environment. We mapped out all inefficiencies and opportunities for automation using the principles of service design. We then consolidated our findings into a map, driven by an overarching theme of simplification and ease.

We then used participatory design to conduct workshops with key decision makers internally and externally to identify product principles, preferred interfaces and language that resonated with their experience.

Insight: The participatory process shaped decisions for the digital financing platform, which prioritized ease of use, speed, and accessibility when dealing with complex workflows

Conclusion

Our findings let us to build an internal loan management system that enabled us to speed up processing, disbursement and renewal times. In less than a year, CreditBook had disbursed over 8,000 loans in under 14 hours each and onboarded 12 new partners for embedded financing and direct lending.